Culture-driven finance

Master Thesis project

Role

Service Designer

Design Researcher

Where

Glasgow, Scotland

Duration

4 months

What?

Strategy

Finance

Co-design

Research

DEI

Culture

Advocacy

Mapping

Frameworks

This project investigates how design and strategy can help financial institutions adapt services for multicultural audiences. The outcome is a set of tools to support designers in building a strong business case for inclusion within large organisations.

A lack of cultural adaptation in high-street banking

Failure to take foreign customers into consideration

Secondary research revealed key statistics highlighting the scale of immigration in the UK and the limited integration of foreigners into the UK’s mainstream financial system. Here are some key findings:

As of 2024, around 10% of the UK population is made up of overseas immigrants. Whether arriving for work, study, or family reasons, they all face one common challenge: adapting to essential services in the UK—especially banking.

45% of families with foreign-born parents live in poverty, compared to 24% of families with UK-born parents.

Foreigners in the UK often face barriers to financial services:

-

Difficulty opening bank accounts due to lack of UK-specific documents

-

Non-transferable credit history limits access to mainstream products

-

A resulting poverty premium increases costs for basic services

-

Language barriers and few translated resources complicate navigation of financial systems

Deepening the knowledge

Understanding the industry & foreign customer's pov

To understand how UK high-street banks adapt services for multicultural audiences, I conducted ethnographic research within a major bank and interviewed experts with relevant experience in large corporations.

I also gathered insights from foreign customers about their banking experiences in the UK.

The research concluded with a knowledge-filling workshop to identify and address any remaining gaps.

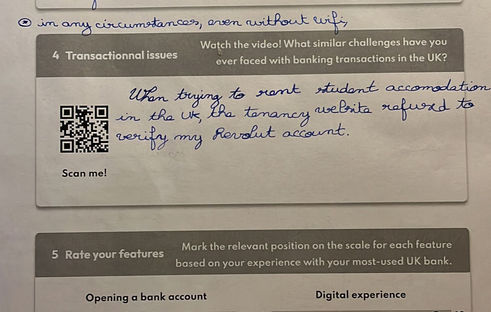

Some activity sheets filled in by foreigners in the UK on their experience banking with various financial organisations.

Making sense of the research

Visualizing complexity

Visually translating my learnings was essential to make sense of the rich insights gathered and to clearly communicate findings to external partners and stakeholders.

Iterating on different artefacts during a knowledge-filling workshop.

Frameworks & artefacts

To synthesise my research, I created three key artefacts:

-

Pain Point Map – outlining the barriers design teams face when creating inclusive services within a large financial organisation.

-

Stakeholder Map – identifying internal and external actors involved in adapting services for multicultural audiences, based on interviews and observations.

-

Designer Journey Maps – developed from interviews with four designers working on inclusive service adaptation. These maps charted their processes, highlighted effective practices, and exposed gaps—helping define key phases and pain points in the journey.

Findings

-

The FCA Is Driving Inclusive Design in Financial Services

The FCA’s 2023 Consumer Duty pushes UK financial institutions to deliver positive outcomes for all customers, including the vulnerable and foreign-born—beyond basic compliance. -

Silos and Hierarchies Hinder Progress

Design, strategy, and tech teams often work in silos, with rigid hierarchies slowing innovation and limiting inclusive design at scale. -

Cultural Adaptation Lacks Strategic Priority

Inclusivity is often seen as a "nice-to-have", not a business priority. Designers struggle to gain leadership buy-in as focus stays on compliance, speed, and quantifiable results. -

No Standardised Approach to Inclusive Design

Inclusive design efforts are fragmented and short-term. Designers lack consistent tools and frameworks to drive lasting, systemic change. -

Inclusivity Needs a Seat in the Boardroom

To create meaningful impact, inclusivity must be recognised as a core business value and embedded in executive-level decision-making.

From research to solution

Identifying my point of action

I merged three Designer Journey Maps into a single ideal process for adapting services to multicultural audiences.

This revealed key pain points and opportunities for impactful design interventions.

With limited time, I focused on the first stage: building a business case to secure buy-in and funding for inclusive service initiatives.

I designed a toolkit to help designers in large financial organisations gather the right data to build a strong business case for multicultural inclusion and secure budget for service adaptation.

After wireframing, I ran three iterative rounds with financial SMEs and stakeholders, refining the tools based on feedback.

The process in picture.

What is the toolkit?

The tools follow a nine-stage process to help designers promote inclusivity and drive internal culture change in financial organisations.

Their main goal is to support a business case that persuades executives to adapt services for multicultural audiences.

Based on Service Design methods, the tools focus on collecting insights from foreign customers, while also engaging stakeholders through workshops and focus groups to foster collaboration and shared ownership.

True transformation requires more than leadership approval—it depends on involving the right people throughout the process to influence, support, and sustain inclusive practices from within.